Through involvement in the stock market and use of mobile apps, such as Mint, students are improving their understanding of money management and future investments.

Financial planning is one of the most difficult parts of growing up and entering adulthood. Many college students have a hard time learning how to budget themselves and manage their spending. However, students can cut unnecessary spending by prioritizing items in their daily lives. Students should create a monthly budget to keep track of funds and to save up for big purchases or “rainy days.”

Most students don’t always have time for a job or are limited by other obligations, so investing in the stock market is a great way to generate a small income. According to Dr. Anindya Biswas, a Spring Hill College finance and economics professor, “There is no good or bad time, the stock market is always changing.” At the start of 2018, the market was very strong, it even skyrocketed the Dow Jones industrial average, but lately it has been in a slump. Although this seems worrisome, market cycles constantly change. The stock market can have good days and bad days, but people overall receive good returns for their money.

When asked what the best investments were for students, Biswas stated, “Never put all of your eggs in one basket. It’s called market diversification. Spread out which stocks you buy and don’t invest all of your money in one thing.” It may seem like a precarious game, but there are simple stocks that do not pose too much of a financial risk. Starting small and growing your existing assets is the best way to ensure financial stability. This allows students to invest and generate income without risking too much.

SHC junior Matt Mimlitz stated, “Mostly, I just invest in the S&P 500 because it’s safe and has consistent growth. It helps me a lot because I’m able to get a good idea of how the market works.” It’s important that students begin building a strong financial foundation for when graduation rolls around.

Although it seems easy to get into the stock market, there are certain factors and risks that students should be aware of before investing. Biswas advised that certain aspects of financial independence should be established first. He stated, “Students need to have a basic understanding of their own finances and should always start small. Go with mutual funds or the S&P 500, then move on from there, investing a little bit more over time. They must set up their IRA account or like a Roth IRA account. If you have any kind of income, you can set up an IRA account; meaning, they’re in the lowest tax bracket and don’t have to pay taxes when withdrawing money.”

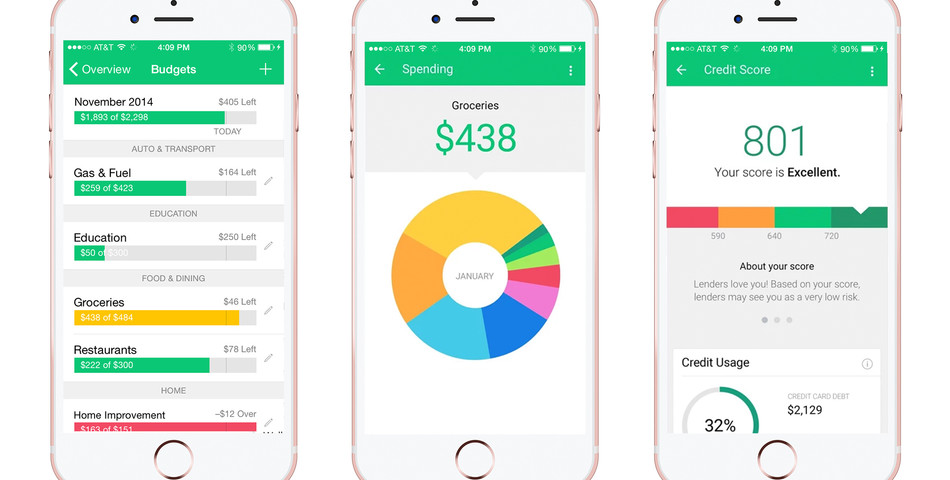

Additionally, modern technological advancements have made financial planning easier through apps like Mint. This new app tracks what you spend by syncing your bank accounts, stocks, credit cards and bills, and provides users a savings and investment projection chart. SHC senior Richard Pellman reflected on his use of the app: “I love using Mint to keep up with what money is coming in and going out in the stock market. I mostly invest in blue collar stocks like Amazon, McDonalds, Google and Nike due to the low risk factor.”

Mint uses this data to show users how much they should be saving and what times are the best for investing. The app is designed to make it easier for young adults to budget, invest in the stock market and save for the future. Whether it’s trying to get into investments, or just saving money day-to-day, starting small is a great way to build up equity.